Learn how to use the platform and get the most out of your experience. Data is de-lagged by removing the data from "lag" days ago thus removing (or attempting to) the cumulative effect of the moving average. Find answers to any questions about how to use TradingView charts, trades, billing, data, desktop & mobile apps and much more. In materials science, effective medium approximations ( EMA) or effective medium theory ( EMT) pertain to analytical or theoretical modeling that describes the macroscopic properties of composite materials. The idea is do a regular exponential moving average (EMA) calculation but on a de-lagged data instead of doing it on the regular data.

#Ema formula series

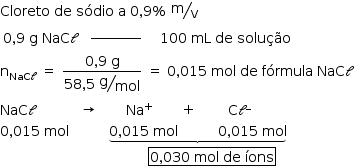

The formula for a given N-Day period and for a given data series is: Lag = P e r i o d − 1 2 EmaData = Data + ( Data − Data ( Lag days ago ) ) ZLEMA = EMA ( EmaData, Period ) Introduction Developed by Perry Kaufman, Kaufmans Adaptive Moving Average (KAMA) is a moving average designed to account for market noise or volatility. Below is the formula to calculate the EMA for a three-point moving average: EMA Latest Value - Previous EMA Value (2 / N+1) + Previous EMA. Īs is the case with the double exponential moving average (DEMA) and the triple exponential moving average (TEMA) and as indicated by the name, the aim is to eliminate the inherent lag associated to all trend following indicators which average a price over time. Exponential Moving Average (EMA) gives higher weight to the latest value and the weights keep on getting lower exponentially for earlier values. The two averages are also similar because they are interpreted in the same. The zero lag exponential moving average (ZLEMA) indicator was created by John Ehlers and Ric Way. Exponential Moving Average (EMA) and Simple Moving Average (SMA) are similar in that they each measure trends.

0 kommentar(er)

0 kommentar(er)